Imagine you’re a baker, whipping up delicious pastries to sell at your local market. Every morning, you’re faced with the same question: How many croissants should I bake to make the most money? Bake too few, and you’ll miss out on potential sales. Bake too many, and you’ll be left with unsold pastries and wasted ingredients. This is the very essence of a fundamental economic principle – maximizing profit.

Image: www.chegg.com

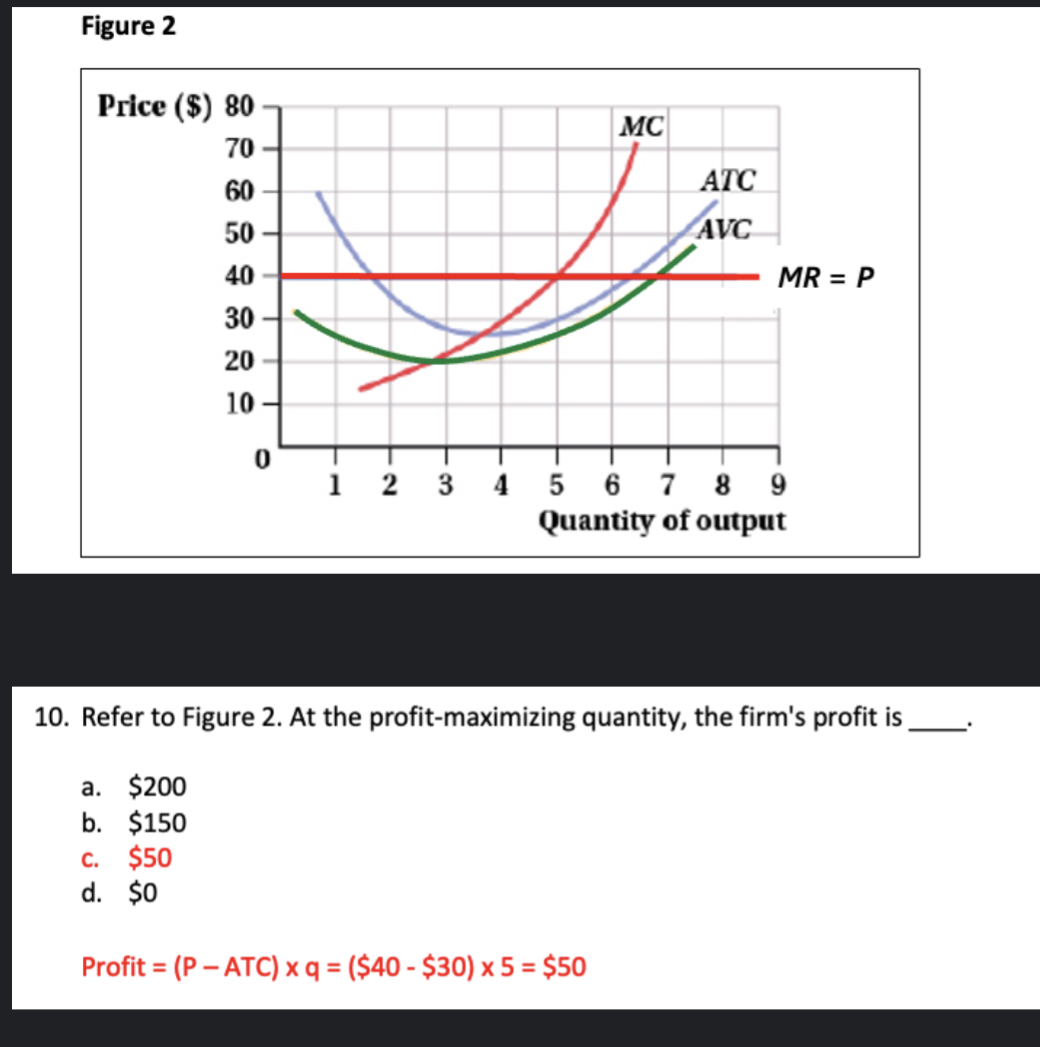

Finding that perfect balance between production and sales is crucial for any business, whether it’s a small bakery or a multinational corporation. Today, we will delve into the concept of maximizing profits, using a classic economic illustration known as Figure 16-5. This model is a powerful tool that helps businesses understand the relationship between production costs, revenue, and ultimately, their profitability.

Understanding the Building Blocks of Profit Maximization

At the heart of Figure 16-5 lies the concept of “marginal” analysis. Marginal cost refers to the additional cost incurred by producing one more unit of a good or service. For example, in our bakery scenario, the marginal cost might be the price of flour, butter, and the time it takes to bake one extra croissant. Marginal revenue, on the other hand, represents the additional revenue generated from selling one more unit.

Figure 16-5 depicts these marginal costs and revenues graphically. The curve representing marginal cost typically rises as production increases – this reflects the law of diminishing returns, meaning that as you produce more and more of something, the additional output you get from each extra unit of input starts to decline. The marginal revenue curve, however, typically slopes downwards. This is because achieving higher sales often requires lowering the price of your product, resulting in lower marginal revenue per unit sold.

The Magic Point: Where Profit is Maximized

The key to maximizing profit lies in finding the intersection point of the marginal cost and marginal revenue curves. This point is where the additional cost of producing one more unit equals the additional revenue gained from selling it, signifying a balanced state of production and sales. Beyond this point, producing more units will actually lead to a decrease in profit, as the additional cost will outweigh the additional revenue.

Why Figure 16-5 is More Than Just a Diagram

Figure 16-5, despite being a simple illustration, provides valuable insights for businesses of all sizes:

- Strategic Decision-Making: By visualizing the relationship between marginal cost and marginal revenue, companies can make informed decisions about production levels, pricing strategies, and resource allocation to maximize their profitability.

- Optimizing Production: Figure 16-5 helps to identify the ideal production level – the point where the marginal cost equals the marginal revenue – thereby maximizing the profit potential.

- Market Sensitivity: Understanding the shape of the marginal cost and revenue curves provides valuable insights into market dynamics. A steeper marginal cost curve, for example, indicates that increasing production becomes increasingly expensive, requiring different strategies for expansion.

Image: www.chegg.com

Beyond the Theoretical: Real-World Applications

Figure 16-5’s concepts are not confined to textbooks. Businesses around the world apply these principles daily:

- Inventory Management: Retailers utilize Figure 16-5’s logic to determine optimal inventory levels, ensuring sufficient stock without incurring excessive storage costs.

- Pricing Strategies: Companies use marginal analysis to set prices for their products, considering the cost of production, demand, and competitor pricing.

- Production Expansion: When considering expanding production capacity, businesses can leverage the marginal cost and revenue curves to evaluate the potential profitability of such investments.

Expert Insights: Practical Tips for Profit Maximization

“Every business needs to understand its cost structure and revenue streams. Figure 16-5 provides a visual roadmap to help you navigate that journey,” says Dr. Sarah Thompson, a renowned economist and business consultant. “It’s not just a static model; it’s a dynamic framework that can adapt to changing market conditions.”

Here are some practical tips from experts to employ the principles of Figure 16-5:

- Track Your Costs: Accurately monitor all costs associated with producing and selling your goods or services – from raw materials to marketing expenses.

- Analyze Your Revenue: Keep a close eye on your revenue streams and identify growth opportunities. Understanding how price changes impact demand is crucial.

- Embrace Flexibility: As market conditions change, be prepared to adjust your production levels, pricing, and marketing strategies accordingly.

Refer To Figure 16-5. The Firm’S Maximum Profit Is

Moving Forward: Embracing a Profitable Future

Figure 16-5 is a powerful tool for gaining a deeper understanding of the relationship between production costs, revenue, and profit maximization. By applying its principles, businesses can make more informed decisions regarding production, pricing, and resource allocation, ultimately leading to greater financial success.

Remember, just like our baker, every business faces the challenge of finding that sweet spot – the point where production and sales harmonize to generate maximum profit. Figure 16-5 provides a visual roadmap to help you navigate this journey, ensuring you bake the right amount of croissants, or whatever your product may be, to achieve your entrepreneurial goals.