Imagine this: you’ve carefully crafted your financial plan, ensuring your loved ones are taken care of after you’re gone. But what if a simple misstep could derail your good intentions? A misunderstanding, a lost document, or a missed communication can seriously disrupt the smooth transfer of your assets. This is where a Beneficiary Letter of Instruction comes into play, especially when dealing with Bank of America accounts.

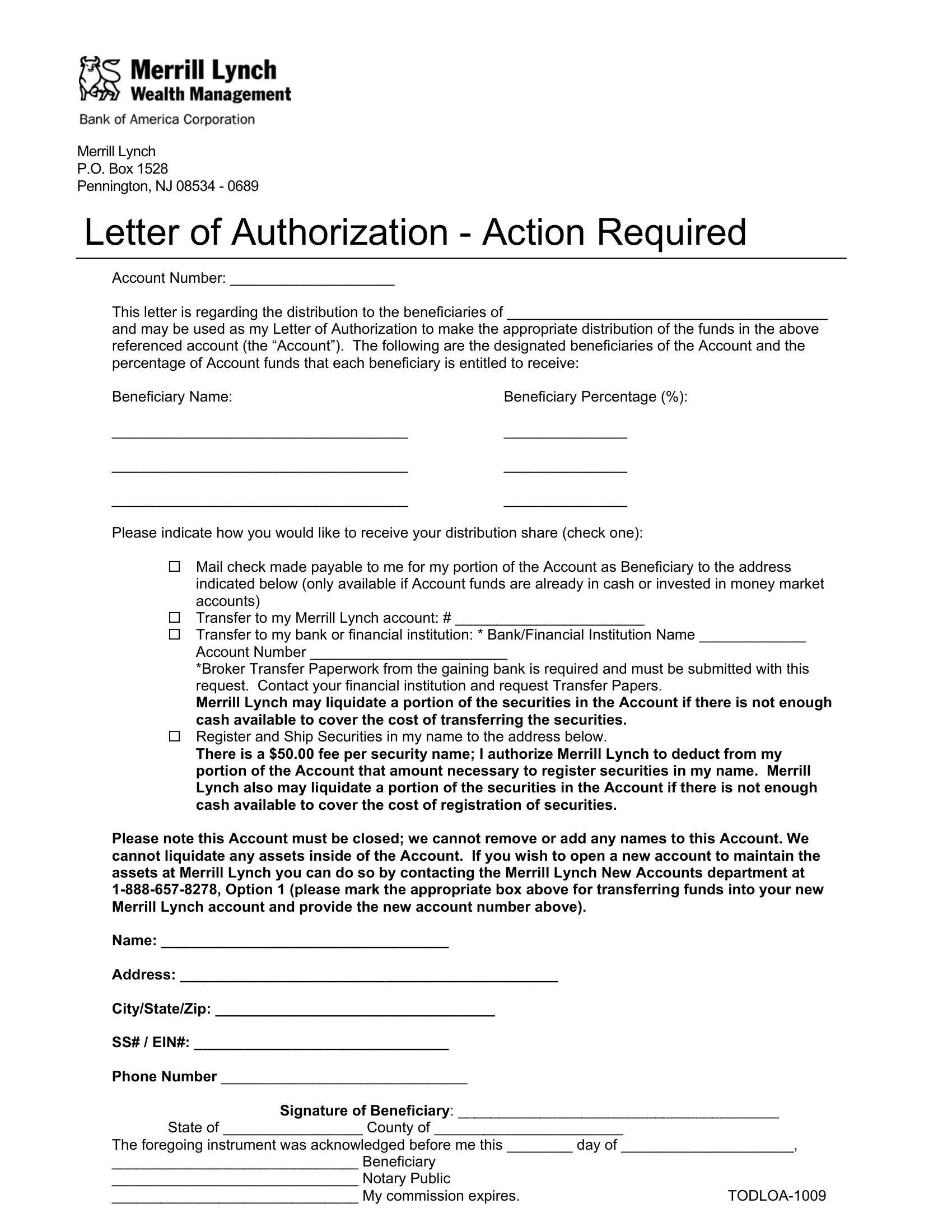

Image: formspal.com

This crucial document, acting like a blueprint for your financial legacy, outlines how you want your assets distributed upon your passing. Think of it as a guide for your executor, ensuring your wishes are followed and your loved ones receive the inheritance you’ve intended for them.

Understanding the Beneficiary Letter of Instruction

The Importance of Formalizing Your Wishes

A Beneficiary Letter of Instruction is a written document that details your desires for the distribution of your Bank of America accounts. While not legally binding, it serves as a vital roadmap for your executor, helping them understand your intentions and make informed decisions about the transfer of assets. It acts as a clear and concise guide, minimizing ambiguity and the potential for disputes among beneficiaries.

Beyond specific instructions for individual accounts, the letter can also address broader wishes regarding your estate. For instance, you might include instructions for charitable donations, specify how you prefer your assets to be managed, or outline your preferences for funeral arrangements. This document allows you to shape your legacy and ensure that your final wishes are honored.

What Information is Included in a Beneficiary Letter of Instruction

A comprehensive Bank of America Beneficiary Letter of Instruction should cover these essential details:

- Account Information: Clearly list all Bank of America accounts you want to include in the instructions, including account numbers, types (e.g., checking, savings, investment), and balances.

- Beneficiary Details: Clearly name each beneficiary, their relationship to you, and the percentage of assets they should inherit. Ensure you use this legal names and current addresses.

- Specific Instructions: State your specific wishes for each account. For example, you might want a specific beneficiary to receive the entire balance of a savings account or a portion of a retirement account. Make sure your instructions are clear and unambiguous.

- Executor Information: Clearly name the person you’ve appointed as your executor and provide contact details. This person will be responsible for distributing the funds according to your instructions.

- Other Instructions: You can also include other important information, such as funeral arrangements, charitable donations, or any specific requests regarding your estate’s management.

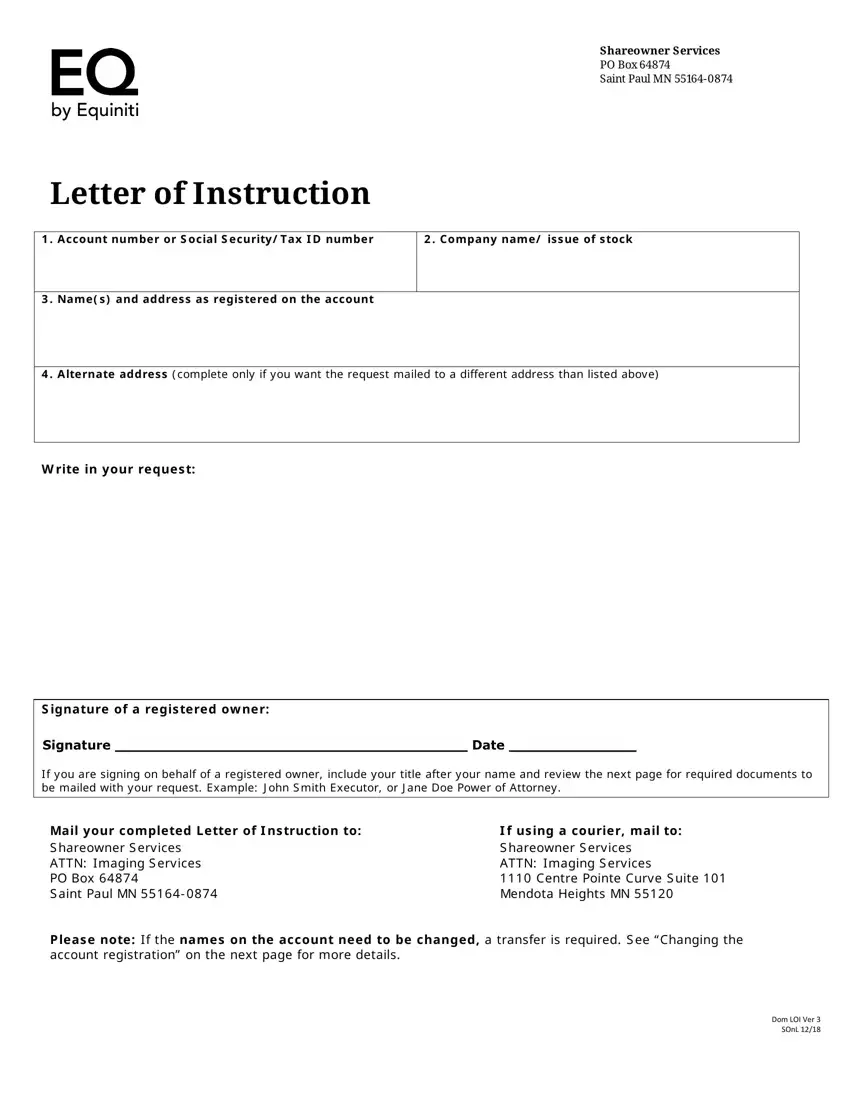

Image: saymaserafim.blogspot.com

Creating a Beneficiary Letter of Instruction

While you can create a Beneficiary Letter of Instruction on your own, it’s essential to consult with a legal professional to ensure it meets legal requirements and effectively reflects your wishes. An attorney can help you avoid common pitfalls and ensure your document is comprehensive, accurate, and legally sound.

Bank of America provides Beneficiary Designations forms for its customers to formally assign beneficiaries for specific accounts. However, remember that these forms only cover those specific accounts and don’t encompass broader estate planning directives. A comprehensive Beneficiary Letter of Instruction, prepared with the guidance of an attorney, allows you to address your wishes beyond individual accounts and ensures smooth estate management.

Tips for Writing an Effective Beneficiary Letter of Instruction

Here are some key tips for creating a comprehensive and effective Beneficiary Letter of Instruction:

- Be Clear & Concise: Use simple language and avoid complex legal jargon. Ensure your instructions are easy to understand, especially for your executor.

- Specific & Detailed: Avoid using vague or ambiguous language when naming beneficiaries and specifying percentages. For example, avoid phrases like “my children” and instead list each child’s name.

- Review & Update Regularly: Life changes, and so should your financial plan. Revisit your Beneficiary Letter of Instruction regularly, especially after major events like marriage, divorce, the birth of a child, or changes in your estate.

- Store Securely: Keep multiple copies of your Beneficiary Letter of Instruction in safe locations, easily accessible by your executor. Consult with your attorney on the best storage options.

- Keep Your Attorney & Executor Informed: Share a copy of your Beneficiary Letter of Instruction with your attorney and executor. Encourage them to review and understand its contents.

By following these tips, you can ensure your Beneficiary Letter of Instruction is clear, accurate, and legally sound, providing a roadmap for a smooth estate settlement and ensuring your wishes are honored.

FAQs about Beneficiary Letter of Instruction

Here are some common questions about Beneficiary Letters of Instruction:

Q: What happens if I don’t have a Beneficiary Letter of Instruction?

A: Without a clear Beneficiary Letter of Instruction, your executor will need to rely on state laws to distribute your assets. This may not align with your wishes, leading to unintended beneficiaries or potentially lengthy legal battles.

Q: Can I change my Beneficiary Letter of Instruction at any time?

A: Absolutely. You can modify your instructions whenever needed, making sure to follow the proper procedures outlined by Bank of America or your attorney.

Q: Should I include my Beneficiary Letter of Instruction in my Will?

A: It’s generally advisable to provide your executor with a separate Beneficiary Letter of Instruction that specifies details about your Bank of America accounts. While your Will outlines your broader wishes for your estate, a dedicated letter simplifies instructions for your executor regarding those accounts.

Q: What if my beneficiary dies before me?

A: You can specify contingent beneficiaries within your Beneficiary Letter of Instruction to ensure assets don’t go to the deceased beneficiary’s estate. This prevents unintended consequences and ensures your wishes are honored.

Beneficiary Letter Of Instruction Bank Of America

Conclusion: Securing Your Legacy

A Beneficiary Letter of Instruction is more than just a document; it’s a testament to your love and care for your loved ones. It’s about ensuring your financial legacy is handled with clarity, minimizing potential disputes and guaranteeing your wishes are fulfilled. This doesn’t have to be a daunting task. By working with a qualified attorney and following the outlined tips, you can confidently craft a document that provides peace of mind, knowing your legacy is protected.

Do you find this information about Beneficiary Letters of Instruction beneficial? Share your thoughts and questions in the comments below!