Imagine you’re on a quest to build a house. Bricks and mortar are essential, but without a solid blueprint, your dream home becomes a chaotic pile of materials. Similarly, in the realm of financial reporting, a conceptual framework acts as the blueprint, guiding the creation of transparent and reliable financial statements. Within this framework, one crucial element stands out: relevance. This isn’t just about “being there”; it’s about information that makes a difference, information that’s capable of influencing decisions and shaping the future.

Image: www.chegg.com

Relevance, in the context of financial reporting, boils down to providing information that is capable of making a difference to those using it. This is a seemingly simple concept, but its power lies in its ability to steer users towards making informed decisions. This article delves into the core of relevance, explaining its intricate components and showcasing its vital role in creating meaningful financial information.

The Foundation of Relevance: A Deep Dive

The conceptual framework, as established by the International Accounting Standards Board (IASB), outlines the bedrock principles underpinning the preparation and presentation of financial statements. Relevance is one of the primary qualitative characteristics of these statements, alongside reliability. To grasp the significance of relevance, let’s break down its two key components:

1. Predictive Value:

Financial information possesses predictive value when it helps users form expectations about future events. It’s like having a weather forecast; the data helps you predict whether to grab an umbrella or sunscreen. In financial reporting, predictive value is illustrated when information allows investors to forecast a company’s future earnings, potential growth, or future cash flows.

2. Confirmatory Value:

Imagine you’re assessing a company’s financial performance. Confirmatory value provides you with the tools to confirm or refute your previous expectations. It’s akin to comparing a product’s actual performance to its advertised specifications; the information confirms or debunks your initial perception. In financial reporting, confirmatory value manifests when information aids users in validating or modifying their prior assessments of a company’s performance, profitability, or risk.

Image: pauex.com

Beyond the Basics: Understanding the Nuances

The concept of relevance extends beyond just providing information. It delves into the realm of influence, ensuring that the information presented has the capacity to make a real difference in decision-making. Picture this: you’re presented with a mountain of financial data. But if that data lacks relevance, it’s akin to trying to build a house with unidentifiable materials — the result is chaos, not a home.

1. Materiality: The Threshold of Significance

Within the framework of relevance lies the concept of materiality. Consider it the “Goldilocks principle” of information — it needs to be just right. Financial information is deemed material if its omission or misstatement could influence the decisions of users. Imagine a company neglecting to disclose a significant lawsuit in its financial statements. This omission could be material, as it might impact an investor’s investment decision.

Determining what constitutes materiality is a nuanced process, taking various factors into account. The nature of the information, its potential impact on users, the specific users, and their individual needs all contribute to the evaluation of materiality. Financial reporting standards provide guidance on how to assess materiality, but ultimately, it’s a judgment call based on professional expertise and a thorough analysis of the circumstances.

Example: A company might deem a small change in depreciation expense immaterial if it doesn’t significantly alter its overall financial position. However, if this change leads to a significant decrease in reported profits, it could become material, influencing investor decisions.

2. Relevance and the User’s Perspective: A Tailored Approach

Remember, relevance is not a one-size-fits-all concept. The information needs to be relevant to the specific users accessing it. Think of it like tailoring a suit; you wouldn’t dress a businessman in a ballerina’s attire. Similarly, financial information must be tailored to the needs of its users — whether investors looking to make investment decisions, lenders assessing credit risk, or customers evaluating a company’s long-term viability.

Each group has unique information needs, and the information presented must be relevant to their specific objectives. For example, a creditor might be more interested in a company’s short-term liquidity, while a long-term investor might focus on its growth potential.

Example: Imagine a pharmaceutical company developing a revolutionary new drug treatment. For a potential investor, information on the drug’s clinical trial results, regulatory approvals, and projected market share would be highly relevant, as it could influence their investment decision. However, for a customer looking to purchase existing medications, this information might hold less relevance.

Unlocking the Power of Relevance: Expert Insights and Practical Tips

Relevance is a guiding principle that empowers businesses to provide meaningful financial information. It ensures that the information presented has the ability to shape informed decisions and drive positive outcomes. Here’s how you can leverage the power of relevance in your own work:

1. Focus on the User:

When preparing financial statements or any other financial communication, always prioritize the user’s perspective. Ask yourself: “What information would this user need to make informed decisions?” Be intentional about communicating the information that is most relevant to their specific objectives.

2. Emphasize Predictive and Confirmatory Value:

Remember that relevant information not only reveals current information but also aids in predicting future events and confirming or refuting past expectations. Aim to provide insights that help users anticipate future trends and assess the reliability of their prior assessments.

3. Adhere to Materiality Guidance:

Understand the concept of materiality and its critical link to relevance. Make a conscious effort to determine which information is material and must be disclosed. This requires careful consideration of the nature of the information, its potential impact on users, and the specific context.

4. Consider the User’s Background and Knowledge:

Recognize that the relevance of information depends on the user’s understanding and experience. Ensure that the information is presented in a clear and understandable manner, adjusted to their level of expertise. Avoid using technical jargon or complex financial language that could hinder their comprehension.

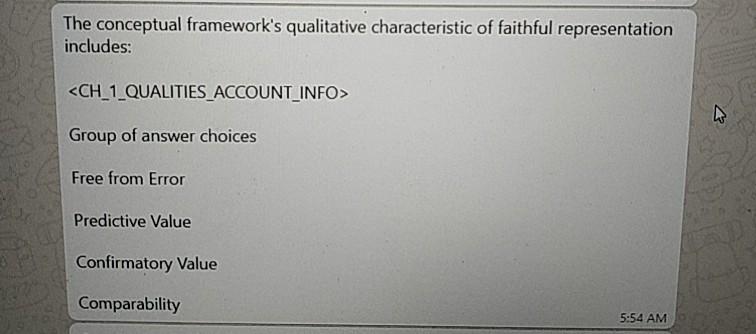

The Conceptual Framework’S Qualitative Characteristic Of Relevance Includes:

In Conclusion: The Importance of Relevance in Building Trust

The conceptual framework’s qualitative characteristic of relevance is not simply a technical detail; it’s a bridge connecting financial information to its users. It’s about ensuring that the data presented isn’t just “there” but is capable of making a true difference. Relevance empowers users to make informed decisions, contributing to the overall transparency and reliability of financial reporting. It also fosters a sense of trust between businesses and their stakeholders, ultimately paving the way for a more robust and ethical financial world. By embracing the concept of relevance, businesses can communicate effectively, build stronger relationships, and navigate the complexities of the financial landscape with confidence.