In our increasingly digital world, it’s easy to forget the traditional methods of handling financial transactions. However, there are still times when a physical authorization letter is required, especially when dealing with bank accounts. For instance, I once needed to help my elderly neighbor withdraw funds from her account, but she was unable to visit the bank due to her health. This experience highlighted the importance of understanding the proper procedure for authorizing someone else to access your bank account.

Image: mavink.com

This guide provides a comprehensive overview of authorization letters for bank withdrawals, offering sample templates, essential information, and helpful tips. It aims to demystify this process and equip you with the knowledge to confidently handle such situations.

Understanding Authorization Letters for Bank Withdrawals

An authorization letter is a formal document that grants another individual the legal right to withdraw funds from your bank account on your behalf. These letters are commonly used in various situations, such as when:

- You are unable to visit the bank due to illness, travel, or other circumstances.

- You need someone to withdraw funds for you while you are away.

- You wish to grant temporary access to your account to a family member or trusted associate.

These letters are crucial because they provide explicit written consent from the account holder, protecting both the individual withdrawing the funds and the bank from potential fraud.

Creating an Effective Authorization Letter

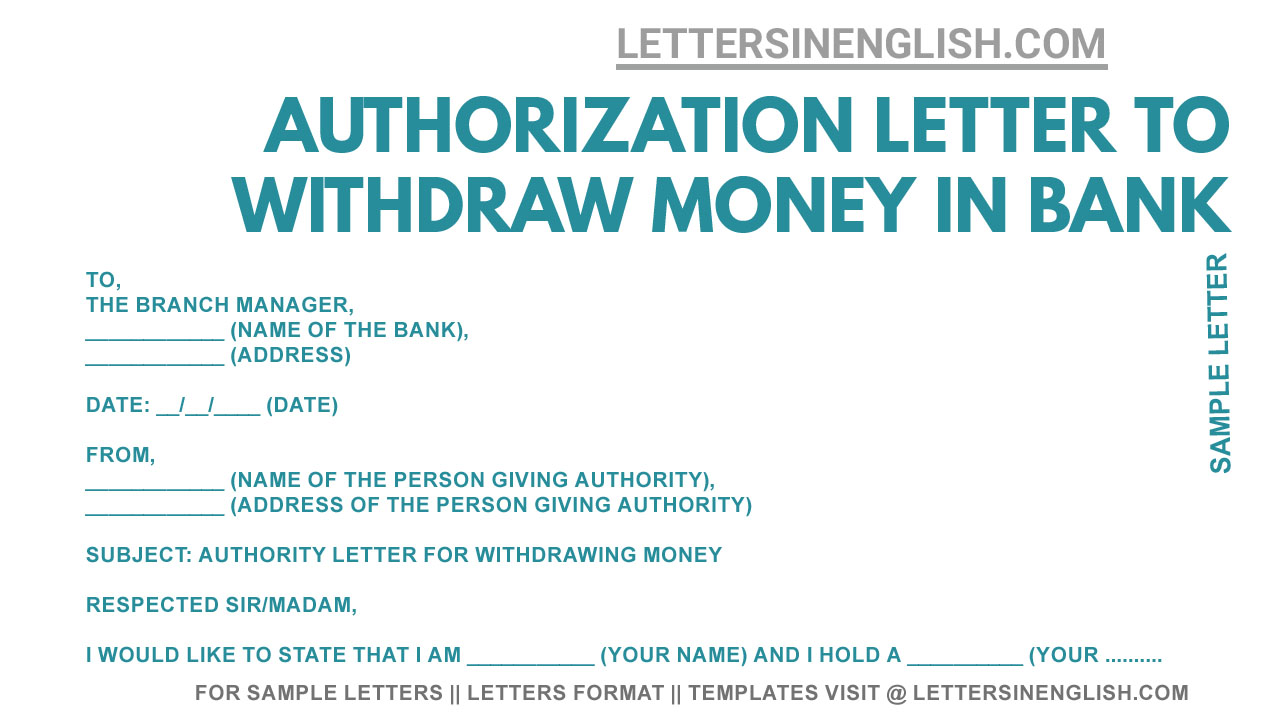

Crafting a clear and concise authorization letter is essential to avoid any misunderstandings or complications. The following steps will guide you through the process:

Step 1: Choose the Right Format

Authorization letters should be written on plain paper and should be formally addressed. Start with the salutation, specifying “To Whom It May Concern” followed by the name of the bank branch. This ensures your letter is received by the appropriate personnel.

Image: materiallistfriedman.z1.web.core.windows.net

Step 2: Include Essential Information

A comprehensive authorization letter should include the following:

- Your Full Name: Clearly identify yourself as the account holder.

- Your Account Number: Specify the account from which the funds will be withdrawn.

- Name of Authorized Person: State the full name of the individual you are authorizing.

- Amount to Withdraw: If applicable, specify the maximum amount that can be withdrawn.

- Purpose of Withdrawal: Briefly explain the reason for the withdrawal. This could be for medical expenses, to pay bills, etc.

- Duration of Authorization: Indicate how long the authorization is valid for. If it’s a one-time withdrawal, specify “for one-time withdrawal.” For a specific period, mention the start and end dates.

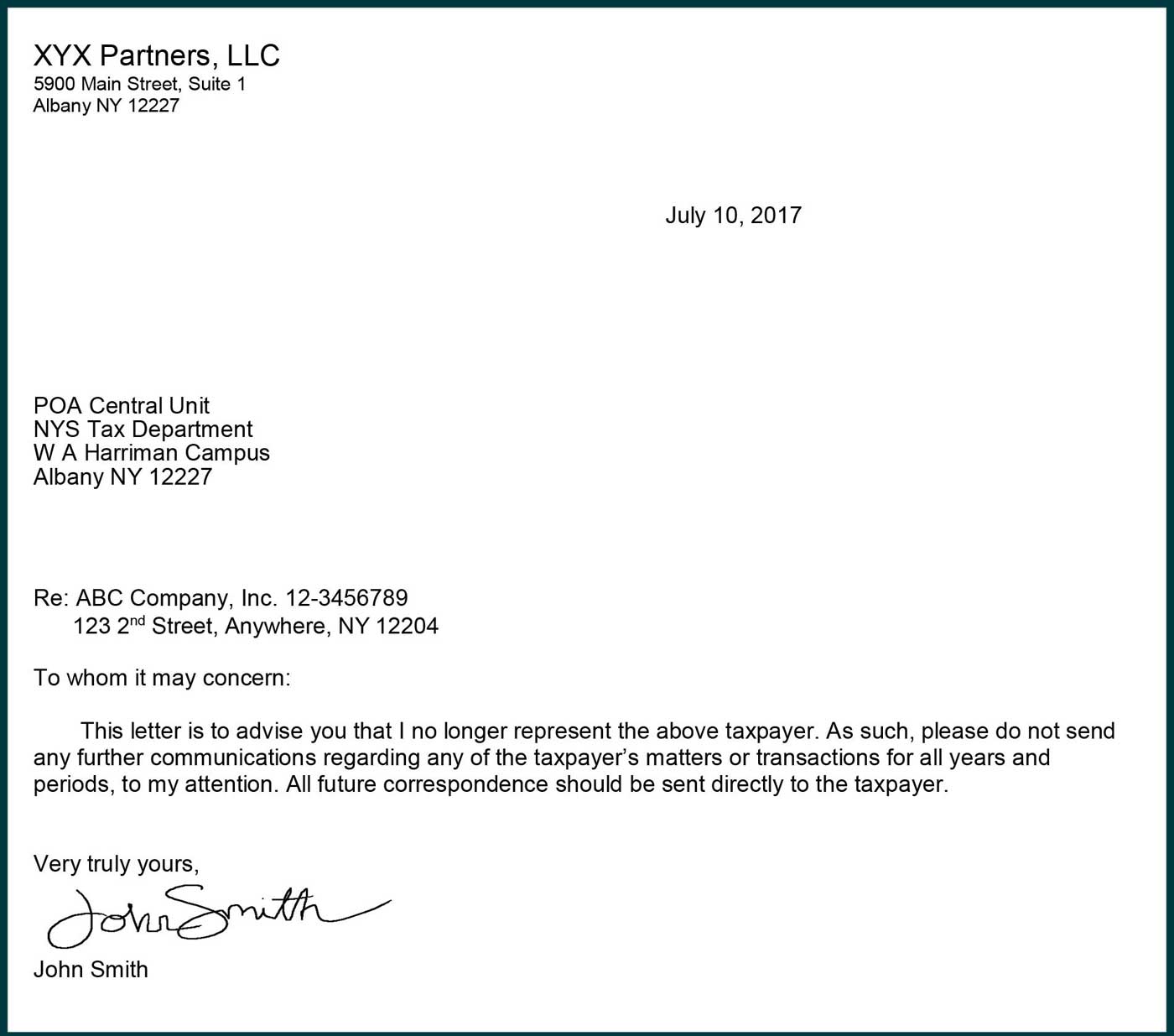

Step 3: Sign and Date

Sign and date the authorization letter in ink, ensuring your signature is legible. This validates your written consent and allows the bank to verify your identity.

Sample Authorization Letter for Bank Withdrawal

Below is a sample authorization letter that can be customized to your specific needs:

To Whom It May Concern,

This letter serves as authorization for [Name of Authorized Person], to withdraw a sum of [Amount] from my account [Account Number], at [Bank Name] branch located at [Branch Address].

This authorization is effective starting [Start Date] and will be valid until [End Date]. The withdrawal is for [Purpose of Withdrawal].

I, [Your Full Name], residing at [Your Address], confirm that I am the account holder and I authorize this withdrawal. This authorization is granted willingly and without any duress.

Thank you for your cooperation.

Sincerely,

[Your Signature]

[Date]

Tips for Success

Consider these tips to ensure a smooth authorization process:

- Keep a Copy for Your Records: Always keep a copy of the authorization letter for your own records.

- Communicate with the Authorized Person: Clearly communicate with the authorized individual about the purpose of the withdrawal and the process to be followed.

- Review Bank Policies: Familiarize yourself with your bank’s specific policies regarding authorization letters. Some institutions may have their own standard forms.

- Use Secure Communication: If you’re emailing the authorization letter, use secure communication methods to protect your sensitive information.

Expert Advice

When authorizing someone to withdraw funds, it’s important to choose a person you trust implicitly. If you are using the letter to authorize a specific transaction, such as paying a bill, consider using a cashier’s check instead of directly giving the authorized person cash. This maintains greater control over the funds and provides a paper trail.

It’s always best to discuss the details of your authorization letter with your bank branch. Their representatives can offer the most accurate and up-to-date information regarding their policies and procedures.

FAQ

Q: What if I lose my authorization letter?

A: If you lose your authorization letter, contact your bank immediately. They may ask you to provide additional documentation or complete a new authorization form.

Q: Can I authorize someone to access my entire account?

A: It’s generally recommended to limit the scope of authorization to specific transactions or amounts. Avoid authorizing someone to have unrestricted access to your account.

Q: Can I revoke my authorization at any time?

A: Yes, you can revoke your authorization at any time. You must send a written revocation notice to the bank and provide a copy to the authorized individual.

Q: Do I need to notarize my authorization letter?

A: A notarized authorization letter is not mandatory in most cases. However, some banks or institutions may require it, so it’s always best to check their specific requirements.

Sample Of Authorization Letter To Withdraw Money From The Bank

Conclusion

Authorization letters are a necessary tool for managing financial transactions when you are unable to do so personally. By following these guidelines and tips, you can create a secure and effective authorization letter that protects your account and allows trusted individuals to access your funds when needed.

Are you interested in learning more about other ways to manage your bank account securely and effectively?